Embrace the coming change and always remember to conduct oneself with integrity and kindness were…

Demystifying private equity

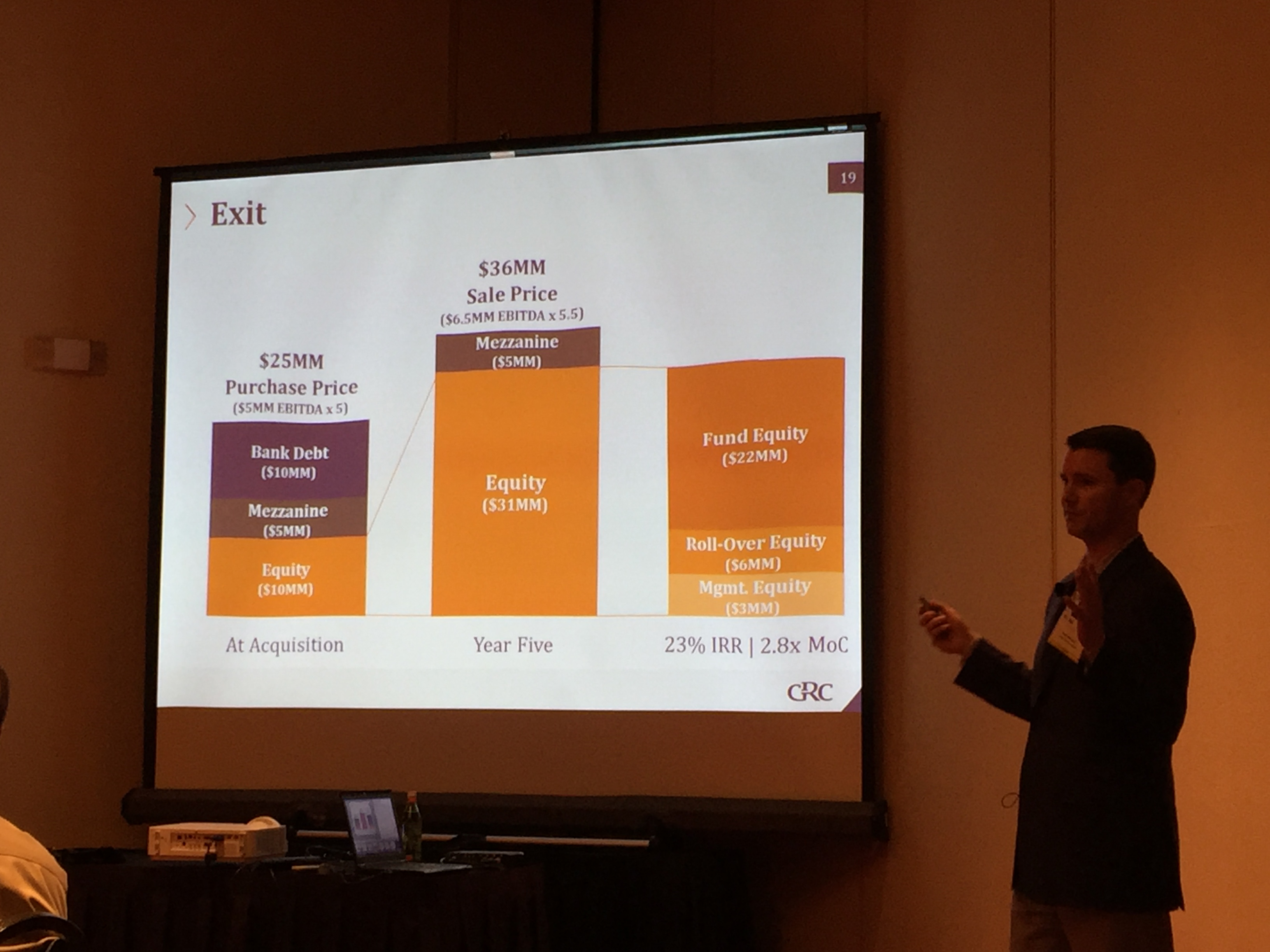

Middle-market companies looking for an ownership transition might consider a buyout by a private equity fund – and benefit from understanding the process in advance – according to Paul Maxwell, managing partner of Great Range Capital. The fund manager walked FEI Kansas City members through the P.E. process from start to finish, including what private equity managers are seeking in investments, the due diligence and negotiation stages, and what private equity partners might bring to a business after the acquisition. Maxwell noted that selling control is a big decision for owners, fraught with emotion. CFOs and other top managers should be brought into the process to maximize the value and benefits to the business after the transition, he said. Great Range Capital is a KC-based private equity fund focusing on “mature but promising” lower middle-market companies based in the Heartland and operating in diverse industries.